Want to drive when you get here? Here’s how to rent a car internationally. Take a few steps before you go, and you should be able to rent a car internationally, no problem. The laws governing car rentals do differ from country to country. Here’s an overview of what you need to know before you go and hit the road.

Here are a few tips to make renting a car outside of the United States easy and safe

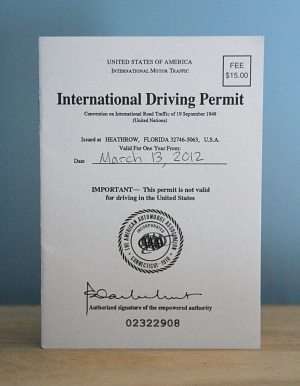

1. Get an International Drivers License/IDP

Most countries will accept your valid state driver’s license with another form of photo ID such as your passport. However, some countries may also require an International Driver’s Permit (IDP) which is available by visiting the American Automobile Association (AAA). Check with an AAA travel office before you travel. You don’t need to take a test to get an International Driver’s Permit; all it does is explain (in a number of languages) the type of license you have, any limitations that apply and when it will expire. You don’t have to have an AAA membership to get an IDP from AAA.

International Drivers Permit

There is a small fee, but AAA is authorized by the US State Department to issues permits. For the small fee and inconvenience, it is worth having an IDP. And get it here before you go: don’t trust unauthorized sources, particularly overseas. They may be scammers who charge you more, and you’ll end up with a worthless and fake permit that is not recognized by the authorities in your destination countries. In these European countries: Austria, Bosnia-Herzegovina, Croatia, Greece, Hungary, Italy, Poland, Romania, Slovenia, or Spain you’re technically required to carry a permit to drive, so get one if you’ll be driving in these countries. If you end up dealing with the police and don’t have an IDP, you could be fined if you don’t produce one, and the fine will no doubt be more than the cost of getting one here. Be sure to travel with your US driver’s license as well.

2. Car Insurance

Your personal automobile insurance policy may have restrictions or limitations on driving in foreign countries. Check your coverage, including the terms of your credit card policy, before you rent in a foreign country. Ask them if you should buy additional coverage offered by the rental agency. In most countries, your rental agreement will include third-party insurance. You should should take it. Some credit cards offer coverage for vehicle damage, personal effects, and accidental injury for international rentals. If the card you’re using to rent the car does, then you won’t need to buy additional and optional coverage.

3. Fines Paid While Driving

In some countries, the police will take your license if you are involved in an accident or stopped for a moving violation and will not return it until you have paid any applicable fine. Get receipts for all payments you make, and report any mistreatment or apparent scams to the American embassy or consulate in that country.

Certain European countries track traffic violations with street cameras that photograph cars at intersections. The police trace the drivers using the license plate number of the car and request payment from the rental car company for the ticket. The rental car company is within its rights to collect the fine from you, even if the company is informed of the violation after you have returned and paid for the car.

4. Age Matters

The age you must be to rent a car varies by country and rental company. Younger renters can incur extra costs, such as having to buy extra insurance or pay a surcharge of $15–40 per day. Most companies will not rent a car to someone under 21 (with some exceptions, depending on the country and type of car), but those who are at least 25 years old should have no problem.

If you’re over 70 you may have trouble renting in the Czech Republic, Great Britain, Greece, Northern Ireland, Poland, Slovakia, Slovenia, and Turkey. In Denmark, you may have trouble if you are over 80. If you’re over 69, you may be required to pay extra to rent a car in the Republic of Ireland, where the official age limit is 75 (although some rental companies will rent to those ages 76–79 if they provide extensive proof of good health and safe driving). Find out the rules for age by country before you leave. Then also compare the cost to rent from here vs. walking into a rental agency at your destination.

5. Border Crossings

In Europe, borders are a hot issue now, and rules regarding whether you can drive a rental car between certain countries could change. Your best bet is to check with your rental company as to what they allow, what additional fees are involved, and what additional paperwork you will need to have. Be sure to state your travel plans upfront to the rental company when you book. Some companies may have limits on which eastward countries you can drive to because of the higher incidence of car thefts for example, you can only take cheaper cars, and you may have to pay extra insurance fees. The best advice is to do your research ahead of time. One alternative to get the freedom a car offers is to consider hiring a private driver for the day or for the duration you’re in a specific country. Hotel concierges and travel agents can help connect you with a driver/private tour guide.

6. Know the Rules of the Road

Foreign countries often have rules slightly different from ours. For example, right turns on a red light are not allowed unless a sign indicates otherwise. Road markings can also be different, so take some time to familiarize yourself with them. The rental clerk may also have tips or a brochure to help you.

7. Great International Driving Tips Resource

Learn about local road rules when visiting a new place or foreign country by first visiting the website of the national transport authority. If you’re planning to rent a car in Europe, AAA publishes some great advice. Also, ask the car-rental company about any unusual road rules you should know about (in New Zealand, for example, left-turning traffic must give way to opposing right-turning traffic, which is completely counter-intuitive for American drivers).

Final Thoughts on How to Rent a Car Internationally

To make driving abroad in a rental car stress-free, you will have to prepare before you go. Start with a conversation with your US car insurance company, then if possible, secure the car rental with a credit card with additional insurance benefits. Next, make sure to get an international driver’s license/permit.

More Articles You May Like